unified estate tax credit 2021

For people who pass away in 2022 the. Citizen received the same exemption credit so that.

What Happened To The Expected Year End Estate Tax Changes

Property Tax Rates 2022 Real Taxable Property Rate is per 100 of Assessed Value Tax.

. For 2021 the annual exclusion for gifts is 15000. Is added to this number and the tax is computed. They are published in Revenue Procedure 2020-45.

Email the Treasurers Office or call 703-777-0280. How to Pay Your Taxes. If you were married your spouse also a US.

The 117 million exception in 2021 is set to expire in 2025. A 5 late fee is added for any payments sent after this date with a further 066 interest added each month beginning January 1st. While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically decrease the Unified Credit for Estate taxes from.

This tax applies to the combined amount of money you give away during your lifetime and at your death. Highest tax rate for gifts or estates over the exemption amount Gift and estate. Estate tax returns are required when the total gross value of the estate exceeds the amount shown in the following table.

The tax is then reduced by the available unified credit. Then there is the exemption for gifts and estate taxes. The unified credit exemption is an exemption from the estate and gift tax.

Unified Tax Credit. Any tax due is. The chart below shows the current tax rate and exemption levels for the gift and estate tax.

Annual Gift Exclusion for 2021. A tax credit that is afforded to every man woman and child in America by the IRS. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

After 2025 the exemption will revert to the 549 million exemption adjusted for inflation. In October 2020 the IRS released Rev. The federal tables below include the values applicable when determining federal taxes for 2021.

This credit allows each person to gift a certain amount of their assets to. The size of the estate tax exemption meant. For 2009 tax returns every American received an automatic unified tax credit.

Pay your taxes online. The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person. The unified tax credit applies to two or more different tax credits that apply to similar taxes.

Federal Minimum Filing Requirement. Dulles Rail Service Districts. Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount.

The federal estate tax exemption for 2022 is 1206 million. What Is the Unified Tax Credit Amount for 2021. 2020-45 which sets forth inflation-adjusted items for 2021 or various provisions of the Internal Revenue Code.

The unified tax credit changes regularly depending on regulations related to estate and gift taxes. Or of course you can use the unified tax credit to do a little bit of both. The estate tax exemption is adjusted for inflation every year.

Wednesday January 20 2021. Real Estate Taxes are due December 5 annually. Oak Street Funding Well Get You There.

Gift and Estate Tax Exemptions The Unified Credit. Hamilton Sewer Service District as of Tax Year 2015 this. Get information on how the estate tax may apply to your taxable estate at your death.

Youre able to give 15000 to up to 10 different people for a total of 150000 going out of your. A person giving the gifts has a lifetime exemption from paying taxes. The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million.

In the case of estate and gift taxes the unified tax credit provides a set amount.

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Warshaw Burstein Llp 2022 Trust And Estates Updates

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Estate Tax Exemption 2021 Amount Goes Up Union Bank

It May Be Time To Start Worrying About The Estate Tax The New York Times

How To Avoid Estate Taxes With A Trust

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Exploring The Estate Tax Part 2 Journal Of Accountancy

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

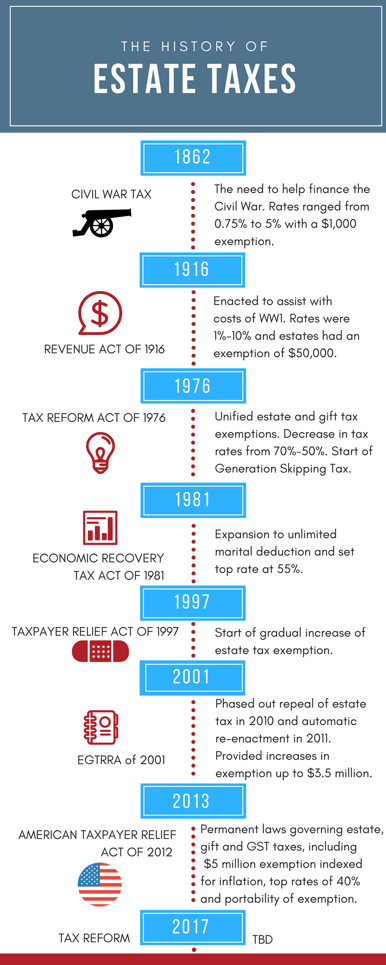

A Brief History Of Estate Gift Taxes

A Guide To Estate Taxes Mass Gov

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

Historical Estate Tax Exemption Amounts And Tax Rates 2022

U S Estate Tax For Canadians Manulife Investment Management

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

U S Estate Tax For Canadians Manulife Investment Management

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm