iowa disabled veteran homestead tax credit

Change or Cancel a Permit. Disabled Veteran Homestead Property Tax Credit Iowa Code section 42515 and Iowa Administrative Code rule 7018013 54-049a 10192020 This application must be filed with your city or county assessor by July 1 of the assessment year.

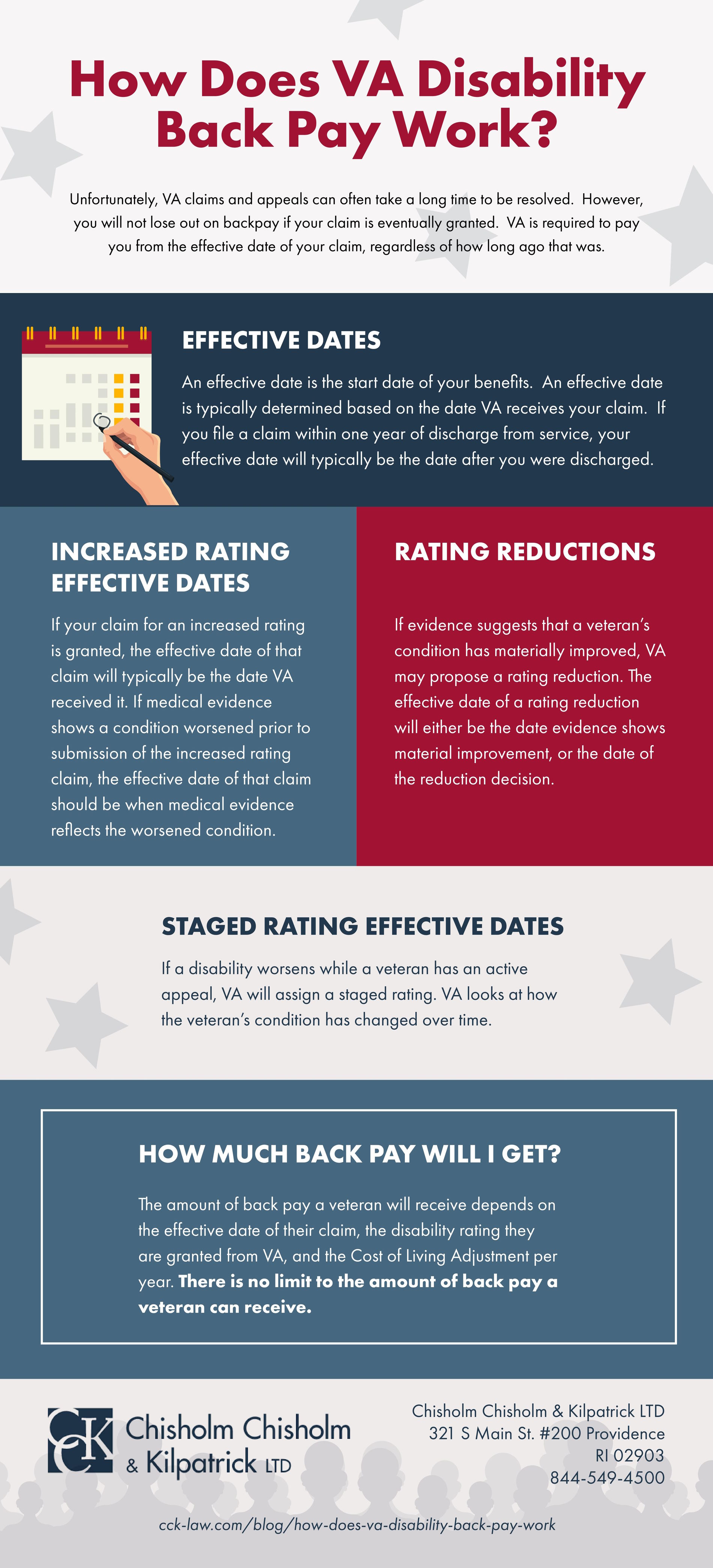

60 Va Disability To 100 Unemployability Tdiu Cck Law

The current credit is equal to 100 of the actual tax levy.

. If the owner of a homestead allowed a credit under this chapter is any of the following the credit allowed on the homestead from the homestead credit fund shall be the entire amount of the tax levied on the homestead. Learn About Sales Use Tax. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

Application for Disabled Veterans Homestead Tax Credit This form must be filed with your county assessor by July 1 annually. Iowa Code Section 42515 Applicant Contact Information. Learn About Property Tax.

Veterans with 100 percent service-related disability status qualify for this credit. Veterans of any of the military forces of the United States who acquired the homestead under 38 USC. IOWA Application for Disabled Veteran Homestead Tax Credit Iowa Code Section 425.

As of now a disabled veteran in Iowa can receive up to full property tax exemption if it can be proven that his or her disability is due to military service. 54-049a 051117 IOWA. Sections 21801 21802 or 38 USC.

Iowa Disabled Veteran Homestead Credit Veterans qualify who have a permanent and total disability rating based on individual un-employability paid at the 100 disability rate. Iowa assessors addresses can be found at the Iowa State Association of Assessors website. This application must be filed with your city or county assessor by July 1 of the assessment year.

This is a 100 exemption for property taxes for qualifying residences used by veterans as their home. Owners of homesteads were eligible for a homestead tax credit equal to the entire tax value assessed to the homestead if they fell into one of the following categories. This legislation from the year 2014 provides 100 exemption of property taxes for 100 disabled service-connected veterans and Dependency and Indemnity Compensation DIC recipients.

The veteran must own and occupy the property as a homestead on July 1 of each year declare residency in Iowa for income tax purposes and occupy the property for at least six months each year. Iowa Disabled Veteran Homestead Credit. Upon the filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as.

No Tax Knowledge Needed. Iowa Disabled Veterans Homestead Tax Credit Description. Veterans as defined in Iowa Code section 351 of.

Permanent 100 disabled do not need to reapply annually. Iowa disabled veteran benefits encourage homeownership by providing 100 exemption of property taxes for 100-disabled service-connected veterans and Dependency and Indemnity Compensation DIC recipients. Originally adopted to encourage home ownership for disabled veterans.

File With Confidence Today. The Disabled Veteran Homestead Tax Credit will continue to be fully funded through the existing standing unlimited State General Fund appropriation. Application for Disabled Veteran Homestead Tax Credit Iowa Code Section 42515.

Based on information provided by the Department of Veterans Affairs the Department of Revenue estimates that 4310 additional veterans will apply and qualify for the credit if the permanent service-connected disability. Iowa assessors addresses can be found at the Iowa State Association of Assessors website. Veterans also qualify who have a permanent and total disability rating based on individual.

Application for Disabled Veteran Homestead Tax Credit This form must be filed with your county assessor by July 1 of the assessment year. Disabled Veterans Homestead Tax Credit. Iowa Code Section 42515.

Register for a Permit. File a W-2 or 1099. Disabled Veterans Homestead Tax Credit Application.

Back in 2015 House File 166 was signed into law. Application for Disabled Veterans Homestead Tax Credit Current decision letter and notification showing 100 disabled required. The bill modified the existing homestead tax credit to include disabled veterans with a permanent disability rating.

Iowa State Disabled Veteran Homestead Tax Credit. The current credit is equal to 100 of the actual tax levy. Upon the filing and allowance of the claim the claim is allowed on that homestead for successive years.

Originally adopted to encourage home ownership for disabled veterans. The State of Iowa offers a Homestead Tax Credit to qualifying disabled veterans with permanent and total disability ratings based on individual unemployability paid at the 100 disability rate. Department of Iowa Revenue Apply.

Iowa Disabled Veteran Benefits for Homestead Tax Credit. The current credit is equal to 100 percent of the actual tax levy. This application must be filed with your city or county assessor by July 1 of the assessment year.

Temporary 100 disabled as of July 1 must reapply annually. Answer Simple Questions About Your Life And We Do The Rest. Iowa Code 42515 Disabled veteran tax credit.

What Is The Veterans Property Tax Exemption The Ascent By Motley Fool

Virtual Vietnam Veterans Wall Of Faces Albert S Knight Iii Marine Corps The Vietnam Veterans Memorial In Pictures Pinterest Marine Corps Vietnam And

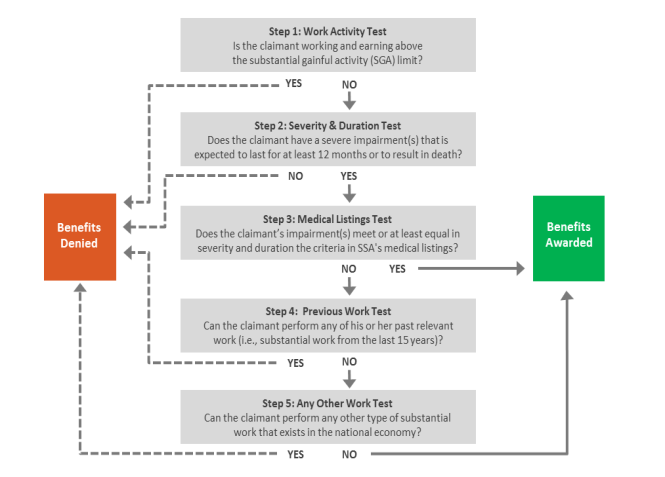

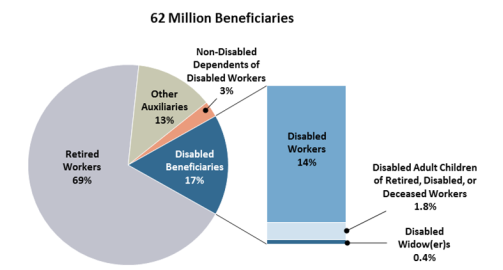

Social Security Disability Insurance Ssdi And Supplemental Security Income Ssi Eligibility Benefits And Financing Everycrsreport Com

Will Social Security Disability Or Ssi Provide Temporary Benefits

Social Security Disability Insurance Ssdi And Supplemental Security Income Ssi Eligibility Benefits And Financing Everycrsreport Com

A Guide To Home Repair Grants For Veterans The Zebra

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem New Homeowner Real Estate Estate Tax

Social Security Disability Insurance Ssdi And Supplemental Security Income Ssi Eligibility Benefits And Financing Everycrsreport Com

A Guide To Home Repair Grants For Veterans The Zebra

5 Tax Breaks For Veterans Turbotax Tax Tips Videos

A Guide To Home Repair Grants For Veterans The Zebra

Dawn Shelley Ms D Shelley Twitter

60 Va Disability To 100 Unemployability Tdiu Cck Law